About Enea Group

ENEA Group is a vice-leader of the Polish power market as regards electricity. It manages the complete value chain on the electricity market: from fuel, through electricity generation, distribution, sales and Customer service.

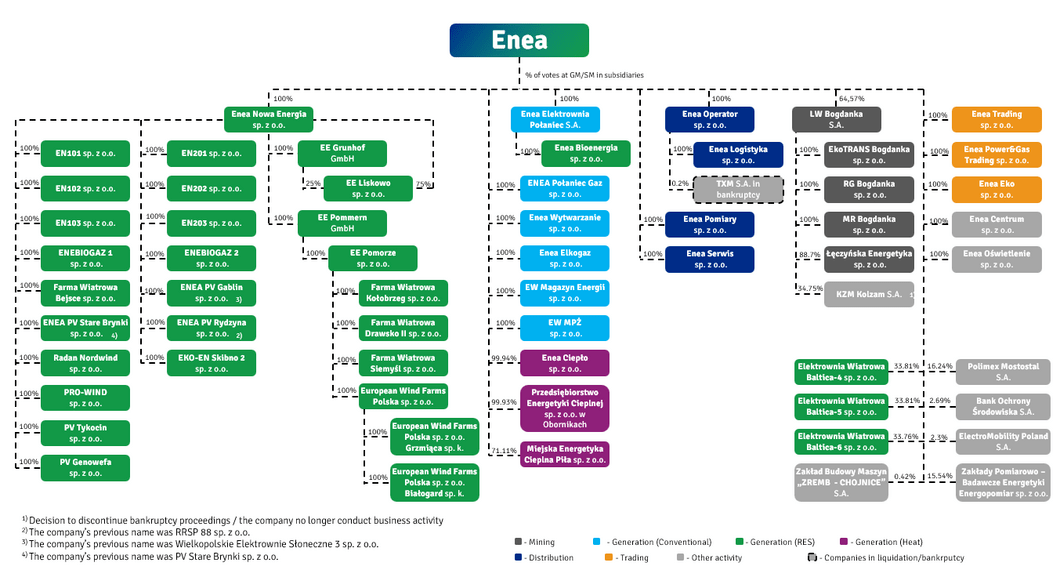

There are 8 leading entities in the Enea Group, namely Enea S.A. (trading in electricity), Enea Operator sp. z o.o. (distribution of electricity), Enea Wytwarzanie sp. z o.o., Enea Elektrownia Połaniec S.A. and Enea Nowa Energia sp. z o.o. (generation and sales of electricity), Enea Trading sp. z o.o. and Enea Power & Gas Trading sp. z o.o. (wholesale of electricity) and LW Bogdanka S.A. (coal mining). ENEA Group’s operations include also heat energy engineering in plants in Białystok, Oborniki and Piła.

Enea Group's business areas

ENEA Group in numbers

Enea Group Structure